Sometimes the risk matrix just isn’t enough for your biggest risk problems. They might be financial loss, a failure to meet the mission of the organisation, or serious corporate social responsibility issues. At times like this really, risk mature organisations will make use of expensive and sophisticated risk processes like:

- Monte Carlo modelling for investment risks and for major projects,

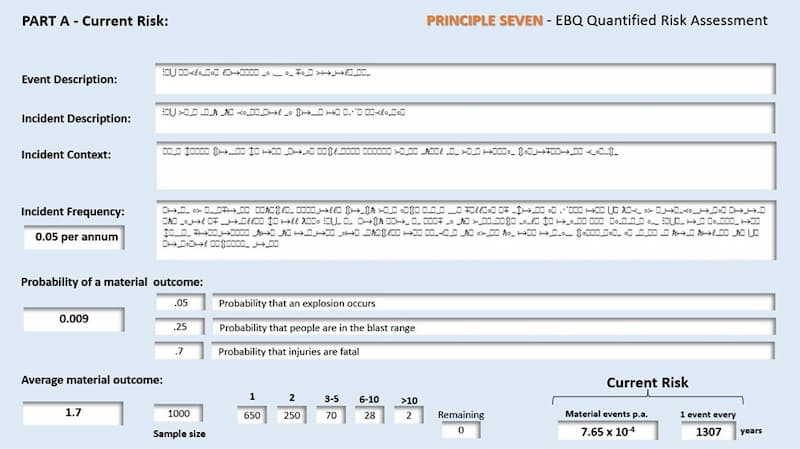

- QRA (quantitative risk assessment) for major HSE disasters using historical data on control failures and computer modelling of the affected area and consequences of a release and/or explosion.

However, there are some quite simple methodologies that use the experience of your team and others in your line of business, to provide sufficient quantification of risk to reduce risk substantially. These models have been used around the world by many large companies.

If you’ve engaged Principle Seven for consulting risk work, these methodologies will be made available to you for free. If you have no intention of hiring me as a consultant, but simply want to understand how they work, please call or send an email. If you like what you see you can purchase them for a one-off payment with no ongoing fees.